Navitas: Refinancing the Shenandoah Project

This article is an English translation of the letter published yesterday in the Hebrew Edition of the newsletter.

💡 To subscribe to the Hebrew Edition, go to your account settings on the newsletter website (epsilontal.com) and select the option to receive emails in The Hebrew Edition (🔗 Account Settings).

The author has an interest in the companies mentioned and may act in them at any time and without prior notice. This article does not constitute investment advice and is not a substitute for independent research. The content reflects personal opinions only and may contain errors. Responsibility rests solely with the reader.

Introduction

Navitas closed the trading day on Jan 21, 2026, at 10,970 points.

Navitas Petroleum has reported a USD 1.35 billion financing transaction to refinance the project-level debt at Shenandoah, replacing ILS-denominated bonds with flexible USD-denominated debt and establishing a flexible credit facility1.

As a reminder, the Shenandoah project has been producing oil for approximately six months. During October, the company reported an increase in production rates to roughly 100,000 barrels of oil per day2.

This allows us to mark another ✅ milestone on the list of value-accretive steps expected under the investment thesis I have outlined in previous posts, with particular reference to the January update.

In the Hebrew Edition:

In the main edition:

At the end of this letter, I will present the updated checklist again.

The Core Concept of Debt Refinancing

🔹 Reduction of FX (foreign exchange) risk: The new debt is denominated in USD, just like oil revenues. This natural matching reduces unnecessary volatility.

🔹 Accordion mechanism: The outstanding debt balance will expand and contract in line with the project's pace and needs. The implication is a lower effective interest cost on average debt over time.

🔹 Improved liquidity at the partnership level: Not only at the Shenandoah project level. This opens operational flexibility for additional drilling and future expansions.

Hedging the Shenandoah Oil Asset

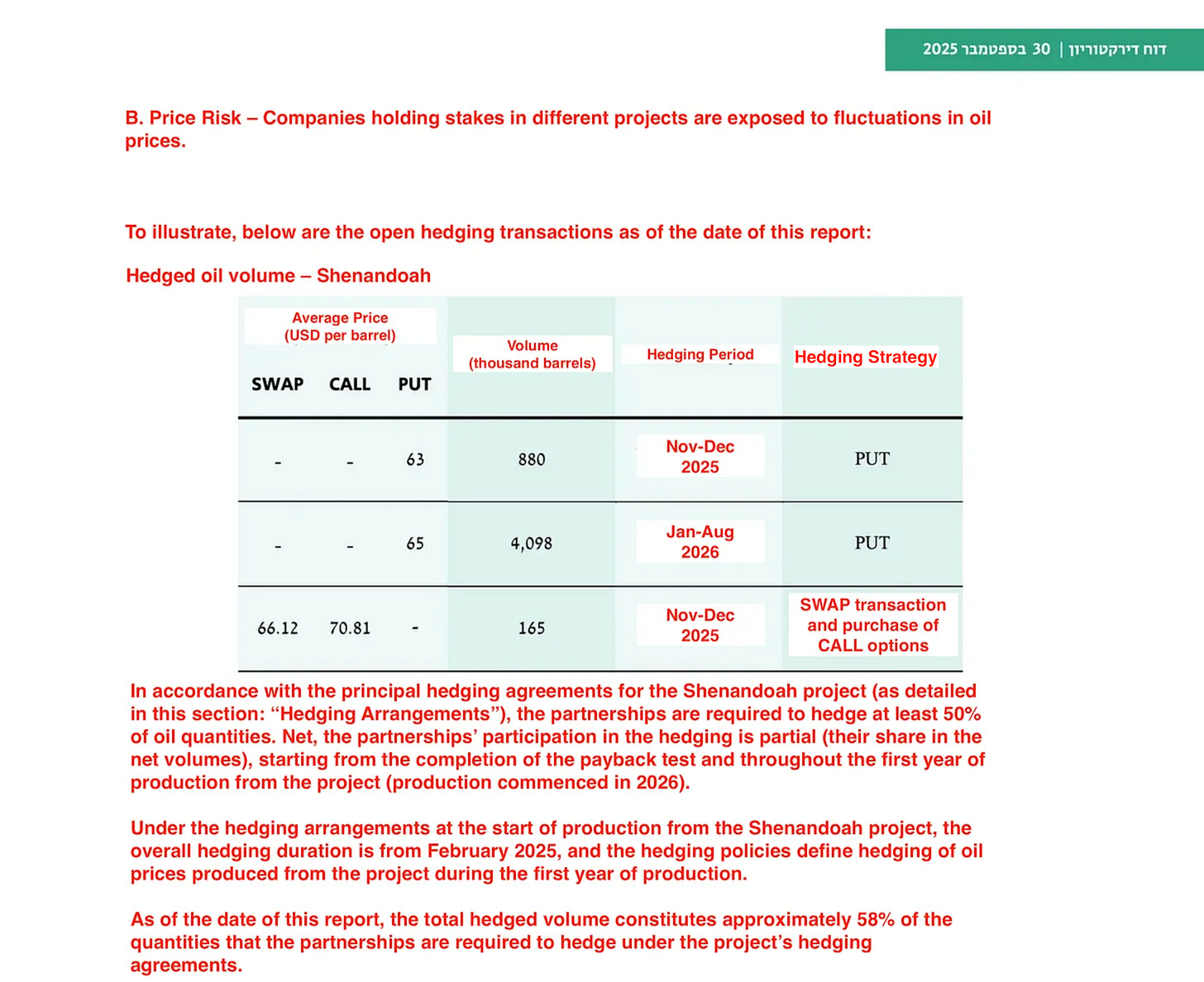

Navitas applies a hedging policy under which a portion of the oil production is sold at fixed prices. As time passes, the hedging tenor is extended or shortened, and the reference price is updated based on market conditions.

When oil prices are high, it makes sense to lock in longer hedge durations. When prices are lower, the opposite applies. This is professional risk management and an art in its own right.

Financing Additional Drilling Going Forward

The geology at Sea Lion (Falkland Islands) is expected to be more favorable for exploration than that at the Shenandoah project (Gulf of America). There are logistical challenges, but these also existed at Shenandoah. This risk is already reflected in the discount rate the market assigns to the project.

Today, unlike during the development phase at Shenandoah, Sea Lion benefits from a strong foundation:

Cash flow from Shenandoah

A reputation of an execution-focused management team that advances and delivers large-scale projects

With a stable cash flow base, execution can move faster. Time is a costly resource in projects of this nature.

Current technology is significantly more advanced than it was 10–15 years ago, reducing the margin of error in exploration.

Sea Lion is on track to production, and upcoming investments will focus on infrastructure development. To maximize economic value, additional wells will be drilled gradually, as is customary in large-scale development projects.

In my view, there is a meaningful chance that the level of contingent resources will not remain the same six months, one year, or two years from now. As drilling progresses, the probability of additional discoveries increases. Local assessments in the Falklands speak of hundreds of millions of additional barrels in nearby areas, while the external evaluator’s reports (NSAI) point to significant potential, despite being relatively conservative.