Navitas Petroleum: Special General Meeting (March 2026)

Available on the Hebrew Edition:

Background

On January 27, 2026, Navitas Petroleum announced the convening of a Special General Meeting1, scheduled for Wednesday, March 4, 2026, at 10:00, to be held at the partnership’s offices in Herzliya Pituach.

The agenda includes several proposed amendments to the partnership agreement. In this letter, I focus on specific clauses that, in my view, are materially important and link them to broader strategic themes I have discussed in recent posts.

Disclaimer: When reading this document, it is essential to emphasize that the information presented is not a recommendation or a call to action. The author has a personal interest in the companies mentioned and may buy or sell their shares at any time, without prior notice. The information presented reflects personal opinion only. The content is not a substitute for individual investment advice provided by a qualified advisor and is not a substitute for the reader’s independent research. The risks associated with commodity price volatility, as well as the possibility that the scenarios presented may fall short or fail to occur, should be taken into account. The reader is solely responsible. Image Source: Beacon Offshore.

Investing Excess Liquidity in Financial Assets (“Interim Investments”)

One of the proposed amendments seeks approval of Section 5.7, which would allow the General Partner, at its discretion, to invest part of the partnership’s excess liquidity in financial assets (“Interim Investments”).

According to this section, Navitas Petroleum will be permitted to engage in mergers, acquisitions, and investments in financial instruments and shares of companies that own oil and gas assets. This means that the company can act indirectly and does not need to invest directly in oil and gas assets. This approach is similar to how Delek Group has operated in recent years. However, these investments are capped at 5% of the partnership’s issued capital.

Fundamental change: Allows the partnership’s management to invest in financial assets, including oil and gas assets, through company investments and mergers. Allows for greater flexibility when cash flow is strong, or capital is abundant, at a time when the supply of oil assets on the shelf at attractive prices (such as Shenandoah and Sea-Lion) is decreasing.

Explicit Authority to Sell Assets or Subsidiaries

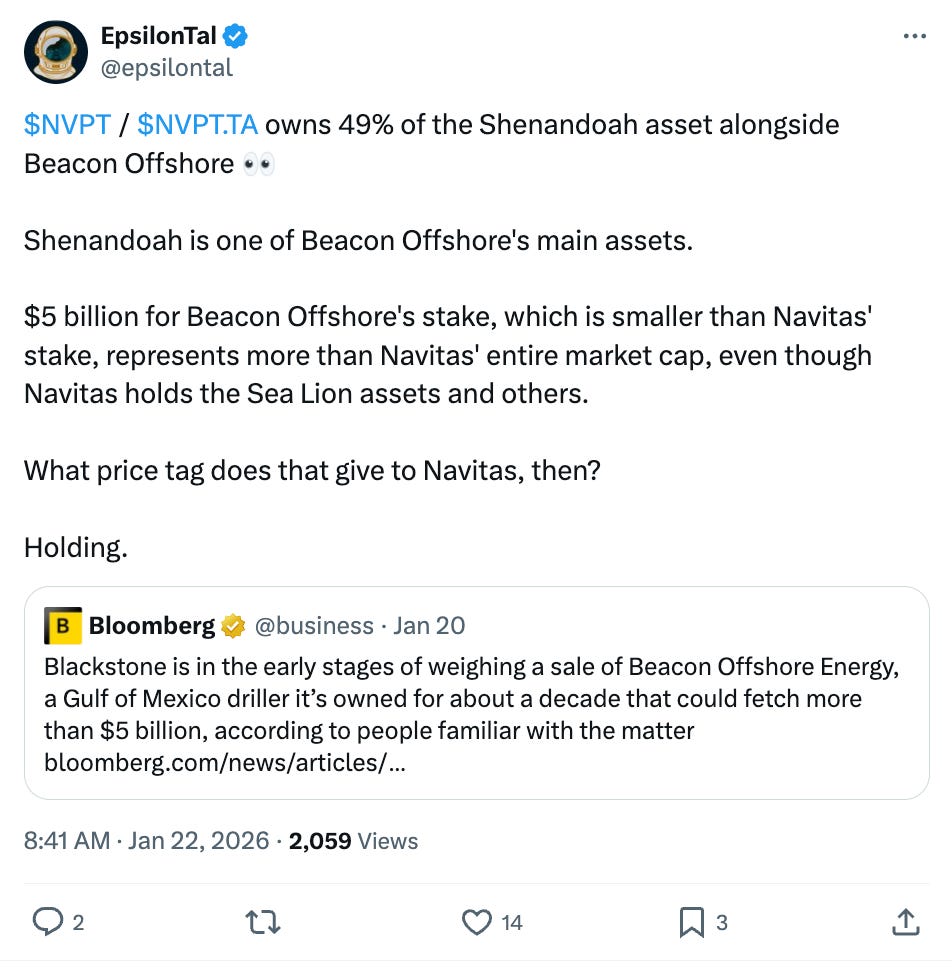

I recently posted on my X account that, according to Bloomberg, BlackRock is putting Beacon-Offshore, Navitas’ partner in the Shenandoah property (30% stake in the partnership), up for sale for an asking price of USD 5 billion, which calls into question the value of Navitas’ stake (49% stake in the partnership).

In a document published by Navitas, the partnership presents for approval at the meeting the proposal to amend Section 12 (“Powers and Duties of the General Partner”), which concerns the authority of the general partner to sell or transfer an asset from the partnership or a corporation held by the partnership, “in whole or in part” —> Is it possible that this is the Shenandoah property and the subsidiary Navitas Petroleum Shenandoah, LLC?

Fundamental change: Allows the partnership’s management to sell oil assets after improving and implementing them, rather than holding them as income-producing assets for long periods.

Expanded Definition of “Distribution” – Including Buybacks

Section 12.3.12: It was clarified that profit distribution also includes “any other distribution,” including the buyback of participation units.

Fundamental change: Allows buybacks as an alternative to dividends, under management authority, a way to return value to the shareholders.